The End of an Era: Discontinuing 3-Tab Shingles and Its Impact on Home Construction and Insurance Claims

The roofing industry is experiencing a pivotal shift due to the discontinuation of 3-tab asphalt shingles. As Jacob Piazza, Director of Roofing Services at itel, aptly puts it, “The phase-out of 3-tab shingles demonstrates the industry’s adaptation to emerging trends and technologies, ensuring roofing systems’ longevity across various conditions.”

It’s not just about aesthetics. This shift is a transformative moment in new home construction and insurance claims, impacting builder practices, insurance risk assessment, and more. As the industry faces the critical need for innovation and creative solutions, it’s crucial for stakeholders to adapt with foresight and resilience.

The Data-Driven Shift: The Impact of Discontinuing 3-Tab Shingles

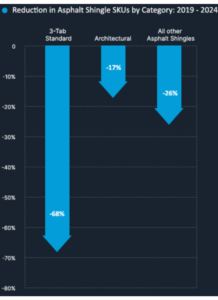

Over the past five years, asphalt shingle manufacturers have streamlined their product offerings, resulting in a notable reduction in unique SKUs. itel’s comprehensive database reveals a staggering 68% decrease in available 3-tab SKUs across the United States during this period.

Since their introduction, 3-tab shingles have been the most affordable option among asphalt shingles. However, their shorter lifespan, compared to alternatives like architectural shingles, has led to a steady decline in popularity among homeowners and roofers alike.

itel’s robust data highlights this market shift and its profound implications. Architectural shingles, valued for their durability and aesthetic appeal, have increasingly replaced 3-tab shingles in new home construction, reflecting consumer demand for longevity and style. This shift is reshaping the roofing material landscape, prompting manufacturers to innovate and introduce alternatives that meet modern construction standards.

Furthermore, the discontinuation of 3-tab asphalt shingles will significantly impact insurance carriers, who are among the largest consumers of these materials nationwide.

Approximately 5% of over 75 million insured homeowners submit claims annually, with wind and hail damage historically comprising a significant portion of these claims. The transition away from 3-tab shingles will affect insurance carriers’ underwriting processes, repairability programs, claims handling, and overall operational strategies. itel’s data-driven insights are crucial for industry stakeholders, enabling them to make informed decisions and adapt proactively to changes.

The Impact of 3-Tab Shingle Discontinuation on New Builds

Builders and developers are swiftly adjusting to this industry shift by enthusiastically adopting alternative roofing materials, such as architectural shingles and metal roofing. These alternatives are gaining popularity due to their superior durability and aesthetic versatility, which not only comply with modern architectural trends but also meet rigorous building codes and exceed homeowner expectations for long-term performance and visual appeal. This strategic transition not only ensures structural integrity but also enhances property value and curb appeal, making it a favored choice in today’s evolving construction landscape.

Overcoming Insurance Carrier Challenges and Finding Solutions

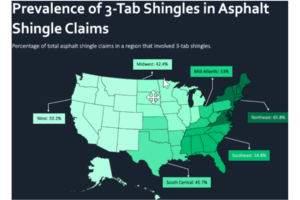

Roofing materials are crucial in shaping insurance claims by influencing their frequency and severity. itel’s extensive data highlights the potential impact of discontinuing 3-tab shingles on insurance claims, particularly in regions where these shingles are prevalent. For instance, in the Eastern U.S., especially the Northeast, nearly two-thirds of homes with asphalt shingle claims in 2023 featured 3-tab shingles, indicating a concentrated regional impact. Insurance carriers operating in these areas will likely face significant adjustments in their underwriting strategies to manage the implications effectively.

Roofing damage often affects only a single slope or a few individual shingles, making targeted repairs a practical and cost-effective solution. However, with the decline in the availability of 3-tab shingles—where itel’s analysis shows that over 54% of cases lack a matching product in the market—carriers may encounter increased challenges in roofing matching and sourcing suitable materials for repairs. This limitation could potentially escalate the need for full roof replacements, significantly impacting claim costs and, most importantly, homeowner satisfaction.

Policyholders will feel the effects of this transition in several ways. Reducing available replacement options for 3-tab shingles may impose budgetary constraints, as alternative roofing materials often come with varying costs. Moreover, the maintenance and repair of existing 3-tab shingle roofs may become more challenging as these materials become scarcer. Conversely, the shift towards architectural shingles and other alternatives promises reduced maintenance needs and enhanced durability, aligning with sustainable living practices.

itel works with technology platforms, contractor networks and materials manufacturers to ensure that insurance carriers, homeowners, and builders are prepared to navigate the evolving terrain of roofing materials and their impact on insurance claims and home construction.

Maximizing Decision Accuracy with Innovative Technologies

Staying abreast of cutting-edge technological advancements isn’t just prudent—it’s essential. Insurance carriers must integrate advanced technologies to optimize processes and deliver a frictionless customer experience. The phase-out of 3-tab shingles presents a critical juncture for carriers to evaluate the efficacy of their repairability programs.

At itel, we are dedicated to pioneering data-driven solutions that set industry standards. Our expansive building materials database catalogs over 20,000 products and 6.7 million data points, offering unparalleled insights into flooring, vinyl siding, and asphalt roofing shingles across the United States and Canada. Continuously updated with real-time specifications, pricing, and retail availability, this database forms the cornerstone of our innovative solutions.

We don’t just have technology; we know how to use it. We enhance the precision and scope of our data analytics by utilizing the newest innovations in machine learning, AI, and optical image recognition. This empowers us to provide insurers, adjusters, and third-party suppliers with precise insights that streamline property claim processes.

Future Trends and Adaptation Strategies Amid 3-Tab Shingle Discontinuation

Looking ahead, stakeholders in the building materials industry must proactively adapt to the evolving manufacturing landscape, particularly with discontinuing 3-tab asphalt shingles in the U.S. market. This shift signifies a significant change that impacts property insurance carriers’ underwriting and claims programs. By partnering with industry leaders like itel, you can navigate these changes effectively, ensuring your property claims program remains efficient and responsive.

Additionally, itel maintains a substantial inventory of discontinued shingles and has significantly expanded its stock of 3-tab varieties over the past year. Through our discontinued materials program, insurance carriers can benefit from automatic reservations when a match is identified during shingle matching tests. This streamlined process allows us to deliver products directly to job sites, offering a cost-effective solution that avoids needing full roof replacements in cases of minor damage.

Our commitment as a trusted intermediary extends beyond data insights to practical solutions that streamline operations and reduce claim costs. We value your partnership and are dedicated to offering exceptional service.

Ready to navigate the roofing industry’s changes with confidence? Contact itel today to discover how our innovative solutions can enhance your property claims program. Let’s keep your operations proactive, efficient, and effective during these and all future transitions.