5 Tips for Modern Insurance Adjusters: Navigating the Digital Landscape

The rise of digital tools, data-driven solutions, and increasing customer expectations demands a modern approach to property claims management. Adjusters face greater pressure to assess damages accurately, ensure fair settlements, and uphold customer satisfaction. In response, partners across the property claims ecosystem are driving innovation, developing solutions that equip adjusters with the tools needed to navigate the future confidently.

Here, we explore key strategies and tips to help modern adjusters excel in today’s digital landscape, tackle industry challenges, leverage big data, and understand why an independent partner like itel is essential for optimizing the property claims process.

Understanding the Modern Insurance Landscape

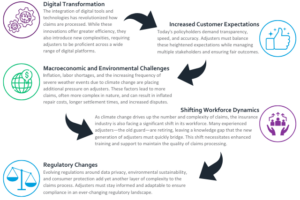

The insurance industry is transforming rapidly, with several key factors adding to its growing complexity. Here are the most critical ones:

With today’s challenges, it’s essential for insurance adjusters to adopt a strategic approach using the latest technology and data insights. At itel, we’re dedicated to equipping adjusters with the tools and expertise needed to navigate this shifting landscape. By leveraging our advanced solutions, adjusters can stay ahead—delivering precise, fair, and efficient outcomes on every claim.

The Adjuster’s Playbook: 5 Tips for Winning Strategies in the Digital Age

1. Leverage Big Data for Informed Decision-Making

In the digital age, data is the absolute backbone of effective claims management. Adjusters can no longer rely solely on experience and intuition; they must harness the power of big data to make informed decisions.

If there is one thing itel understands, it’s data.

Key trends empower you to make data-driven decisions that streamline processes and benefit both homeowners and the environment. Big data isn’t just a tool—it’s essential for delivering the best outcomes for your clients.

2. Embrace Digital Tools for Efficiency and Accuracy

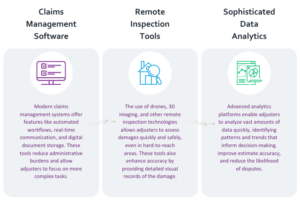

Digital tools are transforming the insurance industry, giving adjusters new ways to streamline processes, improve accuracy, and deliver faster, more reliable results. Today’s claims process relies heavily on technology—from automated management systems and remote inspection tools to data analytics and digital communication platforms.

Proficiency in these tools is essential to access real-time data, safely assess damages, and make evidence-based decisions. Mastering these tools is no longer optional—it’s essential for success in today’s landscape. As the industry advances, tech-savvy adjusters won’t just keep up; they’ll set themselves apart as leaders.

3. Prioritize Customer Experience

Easier said than done. Emotional intelligence (EQ) is essential for adjusters who interact with homeowners during times of stress and trauma. Beyond managing claims, adjusters have the responsibility to offer empathy and support—key factors that shape the policyholder’s experience and the insurer’s reputation.

To focus on this vital human aspect, adjusters need time. Embracing technology like automated claims systems and remote inspection tools streamlines tasks and frees up adjusters to prioritize the homeowner’s experience. McKinsey & Company research shows that prioritizing customer experience can reduce churn by up to 15% and cut service costs by 50%. By leveraging tech, adjusters can make each interaction count, turning tough moments into meaningful connections and driving lasting customer loyalty. In today’s market, EQ isn’t just important—it’s the game-changer for claims management success.

4. Mitigate Environmental Impact

Sustainability isn’t just a checkbox—it’s essential for the long-term viability of the insurance industry. Ignoring sustainable practices leads to unnecessary waste, like discarding repairable cabinets or reusable roofing, adding to landfill burdens and inflating costs for everyone. While climate change and severe weather drive claims volume and complexity, making claims management sustainable is crucial.

Adjusters play a key role here: by prioritizing repairs, selecting eco-friendly materials, and supporting green practices, they can significantly reduce waste and costs. This approach builds trust with eco-conscious customers and positions insurers as true environmental stewards in a rapidly changing world.

5. Stay Informed on Industry Trends and the Latest Technology

Adjusters should prioritize continuous learning by attending industry events, subscribing to trusted publications, and engaging in professional training programs. Networking with peers and leveraging online communities can also provide valuable insights into emerging practices. Additionally, utilizing tools like real-time data analytics and technology platforms keeps you ahead of the curve. By staying proactive, you’ll be better equipped to adapt, innovate, and deliver exceptional results in an evolving industry.

The Vital Role of itel in the Property Claims Ecosystem

In today’s fast-evolving insurance landscape, adjusters need more than traditional tools—they need a partner who brings innovation, expertise, and data-driven insights. That’s where itel comes in. We’re more than just a resource; we’re an essential ally in the claims process, equipping adjusters with a powerful database, sustainable solutions, and the support to stay ahead of industry demands. As claims complexity grows, itel stands ready to ensure forward-thinking adjusters lead the way in accuracy, customer satisfaction, and environmental responsibility. Explore how itel can empower you to navigate the future of claims with confidence and precision.