Normalizing Roof Repairs in Property Claims: An Independent & Objective Approach

While at ITC 2024, Chris Touchton, President of itel, delivered an informative talk titled “Normalizing Roof Repairs in Property Claims: An Independent & Objective Approach.” His session tackled one of the industry’s most significant challenges: how to balance the need for cost control with delivering fair outcomes for property owners, particularly with roof claims. With storms and other adverse weather events increasing in frequency and severity, his message couldn’t be more timely—or necessary.

The Challenge: A Rising Storm

Storm damage to roofs continues to present a complex challenge in property claims. According to a 2023 report from the Insurance Information Institute, insured losses from severe convective storms exceeded $66 billion by the end of 2023, setting a record for a single year (2024 was the second-costliest with $57 billion in overall losses). The increasing frequency of severe weather events—hurricanes, tornadoes, and convective thunderstorms—has been a key driver of these rising costs. Adding to the challenge, inflation and supply chain disruptions have pushed roofing material prices higher, with asphalt shingles experiencing nearly a 20% increase over the past two years.

A key difficulty lies in determining when roof repairs are the recommended course of action and when full replacements are warranted. Unfortunately, some homeowners could be left underfunded when roofs are mistakenly deemed repairable, only to face more extensive issues down the line. Conversely, carriers are often paying for full roof replacements when damage is minor, localized, and easily repairable—an approach that exacerbates concerns about the affordability and availability of insurance coverage.

Regions like Texas, Colorado, and the Midwest—areas with high exposure to hail and storm activity—are especially affected. Rising costs and risk exposure have made it increasingly difficult for insurers to operate sustainably in these markets, prompting some to exit entirely or raise premiums significantly. Finding a balance between repairing a roof and replacing it is crucial for preserving affordability for homeowners while ensuring carriers can continue to provide coverage.

Chris summarized the issue succinctly:

This mindset, Chris explained, is pushing insurers to either leave markets or raise rates—two options that negatively impact both the industry and consumers.

The Accurate Solution Requires a Shift in Mindset

Despite the magnitude of the problem, roof repairs are often underutilized in property claims. Cultural biases and industry practices have created a stigma around repairs, with many homeowners believing repairs are inferior or temporary.

By normalizing roof repairs as a viable and effective solution, the industry can address these challenges head-on. Repairing roofs when that is the most appropriate course of action not only reduces claims costs but also keeps premiums more affordable and ensures carriers can continue to serve high-risk regions.

Overcoming Uncertainty in Property Claims with Objective Decisions Backed by Data

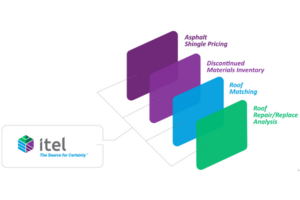

Chris highlighted several key innovations that are already making a difference:

At the core of Chris’s message is the belief that innovation—anchored in data—is the key to transforming the claims process. itel has developed an unparalleled building materials database containing detailed product specifications, pricing, and claims history. This database is the backbone of several tools designed to facilitate fair, objective claim decisions.

What’s at Stake for the Industry?

Without meaningful changes, the property insurance industry faces continued challenges. Rising claims costs are already driving up premiums and forcing carriers to leave high-risk markets, eroding coverage availability. This trajectory threatens not only insurers but also homeowners and the broader economy.

Chris emphasized that collaboration is key to reversing this trend:

By integrating data and leveraging AI, the industry can build a more efficient and transparent claims ecosystem. This reduces friction among stakeholders, accelerates payments, and minimizes disputes—all while controlling costs.

Building a Sustainable Future

Normalizing roof repairs when appropriate is a vital step toward ensuring the sustainability of the property claims market. itel’s vision is one of innovation, collaboration, and shared responsibility, with technology and data at the center of progress. Chris concluded:

itel is leading the charge, demonstrating that the right solutions can address even the most entrenched challenges. For insurers, contractors, and policyholders alike, the stakes are high—but with the tools and insights itel provides, the path forward is clear.

Together, the industry can rise to the challenge, creating a future of smarter claims, sustainable practices, and better outcomes for all. Contact us today to learn how our innovative, data-driven solutions can empower your team and transform your approach to property claims.