Balancing Act: Navigating Accuracy and Speed in Insurance Claims Processing

The old adage says you can do something fast, or you can do it right—but not both. In insurance claims, that tradeoff has long been accepted as an unavoidable reality. But today, technology, advanced tools, and data-driven insights have rewritten the rules. Speed and accuracy are no longer opposing forces—they can, and should, work together.

At the center of this transformation is itel. With a vast proprietary database, innovative solutions, and seamless integration across the property claims ecosystem, itel empowers stakeholders to deliver both speed and precision without compromise. It’s not about choosing one over the other anymore—it’s about achieving both, every time.

Pain Points in Property Claims

Insurance claims handling is a multifaceted task that involves various stakeholders, from carriers and adjusters to builders, homeowners, and third-party service providers. The primary challenges in this process include:

How Technology Enables Balance

Technology plays a pivotal role in addressing these challenges. Advanced data analytics and machine learning (ML) are at the forefront of this technological revolution. These tools can analyze vast amounts of data to identify patterns and predict outcomes, thereby facilitating accurate assessments and reducing the likelihood of errors. For instance, a study by McKinsey & Company found that these technologies help reduce claims servicing costs by up to 30% while also improving accuracy and customer satisfaction.

In addition, technological advancements such as remote assessment tools and digital platforms have transformed the claims process. Drones, satellite imagery, and mobile apps enable adjusters to conduct inspections and collect data without the need for time-consuming on-site visits. Policyholders can also take advantage of these innovations by using mobile apps to report claims, upload photos, and monitor the status of their claims in real-time. This accelerates the claims evaluation and improves transparency and communication among all parties involved. According to TransUnion’s 2025 Personal and Commercial Lines Annual Insurance Outlook, 38% of consumers who shopped for insurance in the past six months switched carriers. These enhancements highlight the crucial role of technology in modernizing the insurance claims operation, making it more productive and effective for everyone involved.

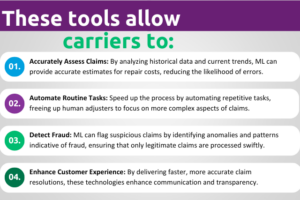

Data Analytics and Machine Learning

Advanced data analytics and ML-powered algorithms can sift through vast amounts of data to identify patterns and predict outcomes.

Remote Assessments and Digital Tools

It’s no secret that digital tools and remote assessment technologies have wholly transformed claims processing, making it faster and more accurate than ever before. The real game-changer is the ecosystem — a combination of advanced tools and platforms that streamline the entire process and significantly improve communication among all parties involved. From drones and satellite imagery enabling remote inspections, to mobile apps that allow policyholders to report and track claims in real-time, these innovations are the secret sauce that enhances efficiency and precision in the insurance industry.

Moreover, companies within the insurance ecosystem—carriers, adjusters, tech providers, and third-party service partners—collaborate continuously to drive innovation. By working together, we develop new technologies and refine existing processes to meet evolving industry needs. This collective effort ensures the ecosystem remains adaptive and, most importantly, resilient — always ready to provide the most accurate and agile claims adjudication solutions.

Virtual Inspections

Virtual inspections have transformed the traditional approach to claims assessments. By utilizing mobile apps, drones, satellite imagery, and video conferencing, adjusters can now conduct thorough inspections without the need for time-consuming on-site visits. Drones equipped with high-resolution cameras can capture detailed images and videos of damaged properties, providing adjusters with comprehensive visual data. Satellite imagery offers a broader perspective, allowing for the assessment of larger-scale damages such as those caused by natural disasters. Video conferencing enables real-time interaction between adjusters and policyholders, ensuring that any questions or concerns are addressed immediately. This shift to virtual and/or remote inspections significantly reduces the time required to complete assessments, allowing for quicker decision-making and faster claim resolutions.

Homeowner Apps

Mobile apps have become a cornerstone of modern claims processing, offering policyholders a convenient and effective way to interact with their insurance providers. These apps allow policyholders to report claims immediately after an incident, upload photos and videos of the damage, and track the status of their claims in real-time. This immediate access to information enhances transparency and builds trust between the insurer and the insured. Additionally, mobile apps often include features such as automated status updates and reminders, which keep policyholders informed throughout the entire claim’s workflow. The process transparency provided by these apps not only improves the customer experience but also helps insurers gather necessary information quickly, expediting the overall claims process.

Platform Integration

Integrated platforms play a critical role in enabling seamless communication and coordination among all stakeholders in the claims cycle. By connecting adjusters, policyholders, contractors, and third-party service providers on a unified system, these platforms ensure that information, documents, and updates are shared effortlessly. With tools like instant messaging, file sharing, and task management built directly into their workflows, stakeholders can stay aligned and avoid delays and miscommunication, ensuring more accurate, timely claim settlements.

Integration of IoT Devices

The Internet of Things (IoT) has introduced a new dimension to claims processing. IoT devices, such as smart home sensors, can provide real-time data on property conditions, enabling:

Early detection of issues: Sensors can detect leaks, fire, or other issues early, allowing for prompt intervention and decrease in damage.

Accurate damage assessment: Real-time data from IoT devices can provide accurate insights into the extent and cause of damage, aiding in precise claim assessments.

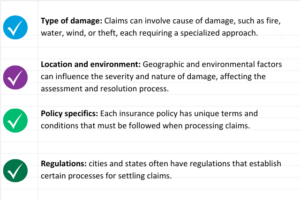

The Unique Nature of Each Claim

No two claims are identical, which underscores the importance of balancing speed and accuracy. The unique nature of each claim arises from various factors, including:

Given these variables, a one-size-fits-all approach is inadequate. Instead, a flexible and adaptive strategy, supported by advanced technology, is essential to ensure that each claim is processed swiftly and accurately.

The Role of itel in the Property Claims Ecosystem

itel stands out as a pivotal player in the property claims industry, leveraging our extensive proprietary database and innovative solutions to support every aspect of the claims process. By addressing key challenges across the claims process, we provide unmatched value:

- Data-Driven Accuracy: Our comprehensive database, built on over 30 years of experience, delivers precise and up-to-date insights for carriers, adjusters, and contractors alike. This ensures fair assessments, reduces disputes, and facilitates confident decision-making.

- Seamless Integration: itel’s tools are designed to integrate effortlessly into existing workflows through platforms like Verisk and CoreLogic, empowering stakeholders to perform swift, accurate inspections and assessments without disrupting their processes.

- Collaboration Across Stakeholders: We foster communication and alignment across the ecosystem, from carriers and adjusters to builders and third-party service providers. Our integrated platforms ensure everyone stays informed and connected, streamlining claims from start to finish.

- Empowering Homeowners: At the heart of our mission, homeowners benefit from transparent communication and fair, unbiased assessments, helping them navigate the claims process with clarity and confidence.

In this complex industry, having an independent partner like itel is invaluable. We deliver impartial, objective assessments and provide fair evaluations that all stakeholders can trust. By combining technology, data, and collaboration, itel empowers the entire property claims ecosystem to operate with greater efficiency, precision, and confidence. This commitment to innovation and connectivity is only part of the story.

Independence and Fairness

The presence of an independent partner like itel in the property claims industry is extremely valuable, as it provides impartial and objective assessments. As an independent source, we offer fair evaluations that all parties can trust.

But that’s just the beginning. itel’s exclusive database—a rich resource of precise data built on 30+ years of industry experience and current innovation—empowers accurate decision-making across the claims process. This wealth of information is essential in an industry where precision can make or break the claims workflow, ensuring that stakeholders have the reliable insights they need every step of the way.

Achieving Excellence in Insurance Claims Processing

For too long, the insurance industry has been trapped in an outdated mindset: you can have speed, or you can have accuracy—but never both. But that’s no longer true. Technology, data analytics, and digital tools have changed the game, proving that speed and precision aren’t opposing forces—they’re two sides of the same coin.

At itel, we’ve embraced this reality. With our proprietary database, cutting-edge solutions, and seamless integration into existing workflows, we have redefined what is possible in the greater property claims ecosystem when it comes to claims administration. Whether its carriers looking for reliable data, adjusters needing streamlined workflows, contractors and third-party service providers requiring accurate insights, or homeowners seeking clarity and trust, itel ensures no one has to choose between doing it fast and doing it right.