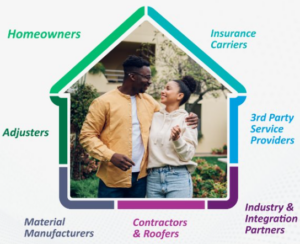

Bringing Solutions Together for a Stronger Ecosystem

Last week at the Elevate conference, our CEO, Brian Matthews, participated in a panel discussion titled “Utilizing Ecosystem Partners to Help You Create an Accurate Scope.” The conversation focused on how everyone in the property claims ecosystem can come together to optimize the claims experience for everyone.

Historically, the claims process has been viewed on a spectrum: speed on one side, accuracy on the other. Insurers had to choose where they fell based on their priorities. But with today’s technology, that tradeoff is no longer necessary. At itel, we believe that leveraging integrations and fostering a strong claims ecosystem can drive both efficiency and precision—without compromise.

Solving the Speed vs. Accuracy Dilemma

One major source of inefficiency has been what’s often referred to as the “swivel chair” problem—adjusters bouncing between multiple platforms, re-entering information, and manually reconciling data. This lost time delays loss assessments and increases the risk of errors. With strategic integrations and API-driven solutions, much of this lost time can be eliminated, allowing for faster, more accurate claims judgements. As Brian Matthews, itel CEO, puts it:

“By leveraging strong ecosystem partnerships, we’re working to integrate these solutions in a way that benefits all stakeholders—insurers, adjusters, contractors, and most importantly, homeowners.”

At itel, we see our role as an independent, third-party, ensuring claims decisions are backed by strong analytics and cost precision from the moment a claim is filed through to repair or replacement.

Normalizing Repairs: A Critical Shift

One of the biggest focuses for itel in 2025 and beyond is aligning claims outcomes with objective data—particularly in roofing. Determining repairability vs. replacement is difficult and nuanced, with multiple factors at play:

- Roof condition and age

- The extent and nature of the damage

- Local building codes

- Material availability

- Policy language

Adjusters often approach these factors differently, which can lead to inconsistent outcomes. In some cases, roofs that could be repaired are unnecessarily replaced, increasing indemnity costs. In others, repairs are enforced by carriers when a fuller analysis would lead to a full replacement recommendation.

“Our encouragement to adjusters is to use as much objective data as possible—whether that’s building code data from OneClick Code, photos from your ladder assist company, or matching results from itel,” says Matthews. “That’s exactly where we’re taking our solution—bringing all of this information together into a single, data-backed report.”

By integrating and putting all these insights into one comprehensive report, adjusters can make more informed decisions while ensuring fair, accurate outcomes for homeowners and contractors.

Freeing Up Adjusters for What Matters Most

One of the biggest concerns adjusters have when it comes to third-party tools is whether they slow down the process. But in reality, independent verification speeds up claims handling by removing subjectivity and reducing back-and-forth negotiations.

“The role of an adjuster today is vastly different from a decade ago,” notes Matthews. “Many adjusters no longer come from contractor backgrounds, and their responsibilities now extend far beyond scoping damage.”

By utilizing third-party verification, adjusters can spend less time on subjective analysis and more time on the interpersonal aspects of claims:

- Explaining policy language to homeowners

- Walking them through the claim process

- Ensuring they fully understand their options

- Providing world-class customer service to ensure policy retention

Better data and streamlined verifications don’t just improve efficiency—they enhance the homeowner experience, fostering the much-needed trust and transparency throughout the claims cycle.

Advice for New Adjusters: Embrace Digital Tools

For new adjusters entering the industry, the biggest piece of advice is to embrace technology. The claims landscape is evolving rapidly, and those who adapt will be best positioned for success.

“Adjusters who stay ahead of the latest digital tools and industry trends will see significant payoffs in efficiency and accuracy,” Matthews advises.

Networking, continuous learning, and professional development are crucial. Events like Connected Claims, Elevate, and INTRConnect provide invaluable opportunities to engage with industry leaders, explore new tools, and stay at the forefront of claims innovation.

A Stronger Ecosystem for a Stronger Future

At itel, we are committed to fostering a more integrated, efficient, and data-driven property claims industry. By leveraging strong partnerships, we aim to enable both speed and accuracy in claims handling—ensuring better outcomes for insurers, adjusters, contractors, and homeowners alike.

The future of claims isn’t just about technology—it’s about how we bring solutions together to build a stronger, more resilient ecosystem.