Adapting to Market Turbulence: Technology’s Role to Help Insurance Carriers

In an industry historically resilient against economic volatility, the insurance sector faces a new era of turbulence. The convergence of evolving customer expectations, regulatory shifts, and global events has created an environment where traditional business models, products, and processes must adapt—or risk becoming obsolete. Technology, particularly data and machine learning (ML), is emerging as the cornerstone for this transformation, enabling insurance carriers to navigate these changes with agility and foresight.

Navigating Property Claims Industry Shifts and Emerging Challenges

The insurance landscape is shifting rapidly. Key factors driving this change include:

- Regulatory Adjustments: Governments and regulatory agencies are re-evaluating regulations to protect consumers, requiring insurers to adjust their compliance strategies frequently.

- Customer Expectations: Today’s customers demand personalized, seamless experiences—far beyond the one-size-fits-all policies of the past.

- Economic Uncertainty: The fluctuating economy demands that insurers remain agile in product offerings and pricing models.

These challenges push carriers to rethink everything, from business models and products to processes and customer engagement strategies. The future belongs to those who can adopt embedded, connected, and immersive business models, design agile, individualized, and holistic products, wrapped in low-friction, customer-centric, and empathetic processes.

The Power of Data and Machine Learning

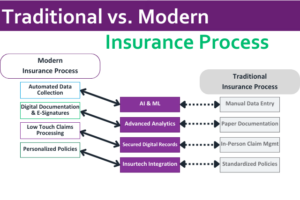

Data and ML are pivotal in helping insurance carriers adjust to these market forces. These technologies empower insurers to:

- Predict and Respond to Market Changes: ML algorithms can forecast trends by analyzing vast datasets, allowing insurers to proactively anticipate market changes and adjust their strategies.

- Personalized Customer Experience: ML-driven insights enable the creation of individualized policies and customer interactions, meeting the demand for customized experiences.

- Streamline Processes: Touchless claims processing, powered by AI, enhances efficiency and increases customer satisfaction by reducing the time and hassle involved in filing and settling claims.

According to Precedence Research, AI will improve productivity in insurance processes and cut operational costs by 40%. This significant impact underscores the urgency for insurers to accelerate the adoption of automation, AI, and advanced analytics.

These technologies empower insurers to streamline operations, facilitate proactive risk management, and personalize customer experiences. Moreover, they help bridge the digital gap, enabling carriers to stay ahead in an increasingly connected world.

To fully harness these benefits, insurers must adopt an ecosystem approach, embracing collaboration with insurtechs and committing to ethical considerations. By working within a broader network of technology partners, carriers can foster innovation and ensure the responsible use of AI and data-driven solutions. This collaborative mindset drives profitability and empowers the industry to address societal and environmental challenges.

Redefining Customer Engagement

At the heart of this technological shift is the customer.

The move towards low-touch, customer-centric processes is not just about efficiency; it’s about empathy. Insurers can no longer afford to be distant or detached; they must be partners in their customers’ financial journeys. Through connected and immersive models, insurers can engage customers in ways that build trust and loyalty, ultimately leading to long-term success.

This is where companies like itel shine.

In the property claims process, uncertainty can cause friction; itel’s solutions are designed to eliminate that friction, ensuring claims settle more quickly and accurately. Leveraging industry-leading data, including over 20,000 building products and more than 6.7 million data points, itel empowers insurers, adjusters, and third-party providers to make informed decisions that benefit all parties involved. For insurers, this translates into a stronger partnership with their customers, built on accuracy, fairness, and empathy.

In a world where customer experience is paramount, itel’s commitment to reducing friction in the claims process exemplifies how insurers can elevate their service offerings. By embracing these advanced technologies and data-driven approaches, insurers are better positioned to build lasting trust and loyalty with their customers, ultimately driving long-term success in an increasingly competitive landscape.

Adapt and Thrive in a Changing Insurance Landscape

As the insurance industry braces for more turbulence, technology offers the tools needed to adapt and thrive. Insurers that leverage data and machine learning to adjust their business models, products, and processes will survive and lead in this new era. The journey to a more connected, customer-centric, and resilient insurance landscape has just begun.

If you’re ready to elevate your approach and ensure long-term success, reach out to us today. Discover how itel’s solutions can empower your business to navigate these changes with confidence and build stronger, lasting relationships with your customers. Let’s work together to shape the future of insurance—where precision, empathy, and innovation lead the way.